Content:

- Introduction

- Submit your offer

- Select your Investing Account

- Sign documents

- Fund your investment

- Oversubscription

- Withdrawing an offer

- Conclusion

In this article, we’ll quickly cover CrowdStreet’s offer process - the steps you need to take to make an investment through the Marketplace. The process may vary for CrowdStreet Advisors products, but this article represents how the process typically works for single-property deals.

Before you begin the offer process, you should carefully review each offering in detail and consult with your legal, tax, and financial advisors.

Here is the most common timeline for the day the deal starts accepting offers. Note: these times can change, so double check the detail page:

- 10:00 AM PT - The webinar begins

- 10:30 AM PT - Submit your offer

- Note: The Invest Now button is activated during the webinar.

- 5:00 PM PT - Sign closing documents

Submit your offer

The first step of the offer process is to submit an offer to a deal.

Click the Invest Now button to submit an offer for a deal. This takes you to the Offer Summary page, the central “timeline” of your offer. Note: this is sometimes referred to as the Transaction Center.

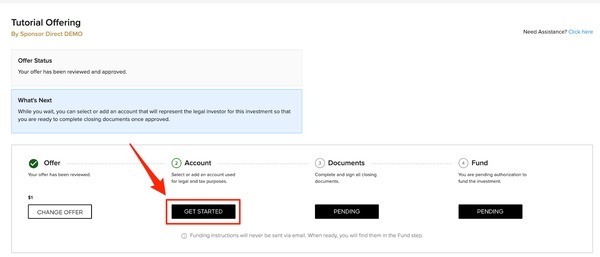

On this page, you see your offer status and next steps. Each step along the bottom shows whether it’s been completed via a green checkmark or if further attention is needed.

Select your Investing Account

The next step of the offer process is to select the Investing Account you want to invest with. Proceed by clicking on the Get Started button below the Account section and selecting an available Investing Account.

This is also a great time to update any missing information and to check your accreditation verification. For investing purposes, your accreditation letter must be valid at the time of documentation review. This review typically occurs within 24-48 hours after documents are submitted (excluding weekends).

Sign Documents

The next step of the offer process is to sign closing documents. Documents are typically released for signing at a specific time, which is 5:00 PM PT.

At that time, the button beneath Documents will switch from pending to get started. You can then sign closing documents. Document submission date and time determines the order in which offers are accepted and whether or not you get into the deal if it oversubscribes. Oversubscription occurs when the value of offers by investors who have signed closing documents exceeds the offering’s maximum allocation.

Note: Due to the various document requirements for each custodian, the signing process for IRA investors is offline. Deal documents are found on the offering's detail page. Initiate your investment directive with your custodian and provide custodian-approved documents to your offer as soon as they are available.

While waiting for your custodian to process your request, you can upload a letter of intent after 5:00 PM PT the evening of the offering webinar to reserve your place in line.

Once you’ve signed and submitted your documents, the CrowdStreet Investor Relations team will review them. Please allow 24-48 hours for review (excluding weekends).

Fund your investment

Funding instructions become available when your documents are reviewed. You’ll need to work with your bank to send funds directly to the sponsor. Want to confirm the instructions? A member of the Investor Relations team is happy to get on a call with you - schedule a call here: verbal confirmation of wiring instructions.

Once you’ve sent funds, fill out the required information and click the Confirm Funds Sent button - this will let the sponsor know to look for your funds. Sponsors usually take 2-5 business days to confirm funds as received.

Once you send funds, the sponsor will countersign documents; you’re invested!

Here are a few things to keep in mind with the offer process:

Oversubscription

When interest in a deal exceeds allocation, the deal is considered oversubscribed. If the offering becomes oversubscribed, investors who do not complete their documents promptly will be moved to a waitlist, while the investors who have completed documents have the opportunity to fund.

Ultimately not all investors who submit offers will be able to invest in an offering that is oversubscribed.

For more information on oversubscription, please refer to the article: Oversubscription overview.

Withdrawing an offer

Offers are non-obligatory until they have been funded. Withdraw your offer by clicking the Change Offer button, then Withdraw Offer. This option is available until you submit a funding method and indicate your funds have been sent.

To withdraw your offer AFTER you’ve sent funds, you will need to contact help@crowdstreet.com for assistance. However, we cannot guarantee that you can withdraw your offer after funds have been sent to the sponsor.