Multifamily is a widely held1 commercial real estate (“CRE”) asset class. While in previous decades, it was generally considered a residential asset, today, it is typically considered one of the four primary CRE asset classes, with the other three being office, industrial, and retail. Multifamily inventory accounts for around a quarter of the U.S CRE footprint with more than $5 trillion in asset value and 18 million units in its inventory belt, as reported by CoStar* at the time of writing.

What is multifamily real estate?

As an asset class or product type, we define multifamily as a single property or complex shared by multiple families as their residence. Multifamily assets span a wide spectrum of residential properties that technically include all buildings containing at least two housing units, which are typically adjacent, either vertically or horizontally. Multifamily is also characterized by shared physical systems such as walls, roofs, heating and cooling, utilities, and amenities. Subtypes can include townhomes, condominiums, apartment complexes, build-to-rent (“BTR”) or build-for-rent (“BFR”) communities, and manufactured houses.

Figure 1: Types of Multifamily Properties

Apartments can come in all shapes and sizes, ranging from dense, high-rise urban properties to sprawling, resort-style complexes in the suburbs, complete with amenities such as swimming pools, fitness centers, and outdoor patios. Making up the majority of the multifamily space, apartments constitute about 45% of the renter's unit mix*. In terms of size and type, multifamily buildings are generally classified as follows:

- High Rise (10+ stories)

- Mid Rise (5-9 stories)

- Low Rise or Garden Style (2-4 stories)

*U.S. Apartment Outlook, Green Street, 2023.

BTR communities are a relatively new subtype of the multifamily sector. These communities offer a hybrid living approach that falls between traditional multifamily and single-family residences. BTR communities are similar to multifamily in that, as the name suggests, they are typically built to be rented out on an annual basis, are clustered across a single property, and generally offer apartment-style amenities. However, they are similar to traditional single-family residences in that they are typically designed to offer tenants more space with detached units and private backyards.

What are the different classes for multifamily?

The industry “grades” multifamily properties as Class A, B, or C real estate based on criteria such as age, quality, amenities, rent, and location, among other factors.

- Class A multifamily properties, particularly in suburban locations, will typically offer near resort-like settings complete with fountains, lavish pools, barbeque areas, and fitness centers. In general, Class A multifamily properties usually command the highest possible rents in their respective submarkets

- Class B multifamily properties are typically a step down from Class A in terms of building quality, location, and amenities. Class B multifamily properties are often associated with the term “workforce housing,” as it is often intended to offer a viable housing solution to median-wage earners

- Class C multifamily properties are the lowest-rated tier of buildings. Spaces within Class C assets may have functional issues and are typically cheaper to rent. Oftentimes, these are older assets that have outdated building systems, designs, or finishes, or they may be in need of maintenance and renovations.

What are common types of multifamily investments?

While there are many types of multifamily investment strategies, two of the most common ways to invest include acquiring existing assets and pursuing new developments, or “ground-up” opportunities. Each type presents a range of risk and reward considerations.

- Acquisition strategies: These typically entail purchasing, operating, and, ultimately, selling a multifamily project. With acquisitions, the strategies may vary widely, from simply maintaining a relatively new project in hopes of maximizing current cash flow to almost completely redeveloping an aging project. Regardless of the scope of the business plan, almost every acquisition strategy looks to increase the asset’s Net Operating Income (“NOI”) over the course of the holding period to potentially enhance its value upon sale.

- Ground-up development: A common strategy for new development, ground-up projects involve constructing, leasing to stabilization, and then selling shortly thereafter. While the timing may vary, such a strategy is often targeted over a three-year period. In industry parlance, this is referred to as a “merchant build.” Typically, the goal for these projects is to maximize the potential equity multiple for the general and limited partners.

What are the different construction types?

Multifamily development can take many forms, each with varying costs. Most municipalities require buildings to be designed and constructed compliant with the International Building Code (IBC). Construction type and finish levels are some of the key determinants of price per square foot and total building costs17, which in turn can influence the rents a property needs to achieve in order to hit its potential target returns. That list, roughly ranging from low to high building costs, includes:

- Stick Built2: “Stick” meaning wooden, the least expensive building style uses primarily wood beams and stud walls. It is more common to find lower-to-medium finish levels in stick-built products.

- Podium3: Also referred to as pedestal or platform construction, this style features a concrete base or “podium” on the first one or two stories with stick-built construction on up to five floors over the podium. That base also may include digging down to create a basement or underground parking garage. It is common to find mid-to-high finish levels in a podium product, given the higher cost as well as the likelihood that it will be developed in an urban location.

- Concrete and Steel2: Also known as Type I buildings, these urban high-rise buildings need heavy-duty structural support to accommodate a very dense, vertical format that will utilize a combination of concrete and steel. Given the high cost of land, cost of construction, and density in this type of location and product, it is more common to find high-end finish levels in concrete and steel buildings.

How is multifamily real estate valued?

When comparing different types of investments, it can be helpful to use certain metrics. Generally speaking, the following two are typically used for multifamily:

- Price per unit/Price per sq. ft: A multifamily property can be valued by its price per unit or its price per sq. ft. For example, an apartment complex in New York may cost $700K per unit, while a similar apartment in Houston may cost $220K per unit. Comparisons with these metrics can be helpful because it can give an idea about how much each individual unit costs and which markets have cheaper and more expensive units. By using this approach, you can also compare a given property to others that surround it that are of similar age and condition to understand if the subject property appears cheap or expensive relative to its “comparable set." Appraisers refer to this method as a “cost approach4."

- Cap Rates: As with other asset classes, another way to value a multifamily property is through its cap rate, which takes the in-place NOI and the income that the property is expected to generate expressed in percentage form. Cap rates are computed by dividing the net operating income of the property by the asset value, or its price. Cap rates are used when comparing different properties. A good rule to remember is that when cap rates go up, the return on your investment typically tends to go down. Appraisers view this method as an “income approach5."

What are the demand drivers for multifamily?

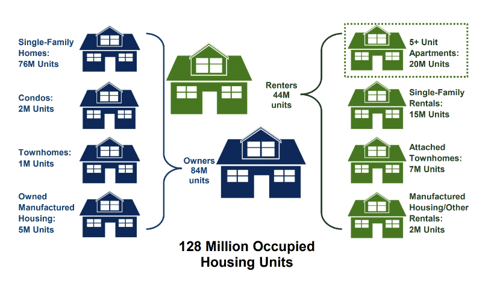

One way to begin analyzing U.S. multifamily demand drivers is to consider that households are composed of either owners or renters. Homeownership in 2022 was at 66%, with renters at 24% of roughly 131.2 million total households, according to the U.S. Census Bureau6.

A rule of thumb to consider is that generally speaking, multifamily demand drivers will 1) increase or decrease the total number of U.S. households, 2) change the percentage breakdown of renters vs. owners, or 3) both.

According to the National Multifamily Housing Council7, the U.S. net rental demand depends upon total population and household size projections, the portion of the market that desires and can afford ownership given the regulatory environment, and other factors that may impact homeownership rates, such as inflation and demographic trends. While there are myriad factors that contribute to multifamily demand, generally speaking, the following comprise some of the key drivers:

- Population Growth: As the population grows, so too does the number of households, albeit typically at a lower rate. Following the great recession, the population increased, yet homeownership declined from its 2004 peak of 69% to its current level of 66% due to the lingering effects of the crisis. The number of renters, however, increased8 between 2006 and 2016 by 23 million, compared to the number of homeowners, which increased relatively flatly by less than 700,000 in the same time period6.

- Job Growth: While the relationship between job growth and multifamily fundamentals has weakened since the onset of the COVID-19 pandemic due to work-from-home trends and fiscal stimulus, job growth remains a key driver of demand and fundamentals, according to Green Street*. Gains in employment typically correlate to household growth, especially when people are able to afford their own residence as a result. For example, children who move out of their parent’s home after they are employed. However, while job growth generally tends to increase the number of total U.S. households, we’ve seen it predominantly pushes up the number of renters because of relative affordability.

* U.S. Apartment Outlook, Green Street, 2023 - Cost of Ownership: Generally speaking, there are two primary ways to analyze cost of ownership. First, high real estate prices can potentially serve as a deterrent to ownership because they can make purchasing difficult. Consequently, you often see a higher percentage of renters in markets where housing is expensive. In fact, while the U.S. owner-to-renter ratio is 66% to 34%6 at the national level, it is nearly the inverse in metros such as New York18, San Francisco19, and Los Angeles20. When the comparative cost of renting vs owning changes, it typically induces demand for the option that is cheaper. For example, when we see rapid spikes in real estate values, particularly ones that dramatically outpace wage growth, we typically see that the renter percentage in that location increases while the ownership percentage decreases. Such a change doesn't increase the household number but rather swings the percentage breakdown between the two.

- Demographics: People’s behavior and choices can have direct effects on multifamily demand. Demographic trends have contributed to the growing popularity of renting. According to a study by Pew Research9, more U.S. households are renting than at any point in the last five decades. Among these renters, young adults who are younger than age 35 are most likely of all age groups to rent instead of own a home.

Although the rate of population and job growth is declining10, the renter’s share of demand is expected to remain relatively strong in upcoming years. Green Street forecasts* that there is demand for approximately 4.7 million total new housing units over the next five years, which is roughly 30% below the pace observed in recent years due to slower population and job growth. However, the renters' share of net demand is still anticipated to increase modestly, while homeownership demand is expected to fall in comparison*.

*U.S. Apartment Outlook, Green Street, 2023

Another consideration is that young adults, as a demographic, are delaying11 marriage and starting families. The effect of these trends has expanded the year-over-year renter pool nationwide. Millennials are also carrying a higher load of student debt in comparison to previous decades11, which can potentially make it more challenging to finance a first-time home purchase. One out of every five millennials believes they will never be able to afford to buy a home11. Statistics indicate that younger households are renting longer and at greater rates as homeownership becomes a less attainable goal12 for many.

Millennials are not the only demographic potentially making choices in favor of multifamily. Empty nesters often find themselves downsizing and opting for low-maintenance rental townhomes, BTRs, and apartments. Typically, both millennials and empty nesters have been drawn to the urban renaissance movement that is seeing people move back to city centers to live, work, and play. We've seen that the resulting movement is creating more demand for rentals in and around busy downtown and central business districts.

What are the potential pros of investing in multifamily real estate?

- Diversified rent roll: We’ve seen that one of the reasons investors may be drawn to multifamily real estate is the diversified rent roll11 typical of these properties. Relying on income from multiple, often hundreds of tenants can be considered potentially lower risk than relying on one or two tenants.,

- Generally readily available (and typically cheaper) debt financing: Multifamily properties typically have a wider availability of debt capital through government-backed agencies such as Fannie Mae and Freddie Mac. The multifamily sector typically benefits from the mandates of these agencies, which are to provide liquidity, stability, and affordability to the US residential mortgage market. These agencies lend on multifamily, senior housing, and student housing assets21.

- Relative mitigating effect during recession: During the Great Financial Crisis, multifamily, among healthcare, self-storage and others, was generally a more resilient asset class* in the face of economic sensitivity. We believe there is something to be said for the notion that people still need a place to live no matter the phase of the economic cycle. During recessions, we’ve seen that people can lose their homes and be forced into the renter’s pool, which may increase rental demand through a shift in the owner vs. renter household ratio. Once a recovery begins, the shorter lease terms of multifamily typically allow owners to adjust more quickly to changing market environments.

*Green Street, Heard on the Beach, “Same As It Ever Was," 2019.

- High average occupancy: Due to the fact that shelter is a basic human need, multifamily typically has high occupancy rates. The average occupancy for multifamily within the last five years was around 94%* and occupancy in 148 out of the nation’s 150 largest metros was at a record high of 96% in 2021, according to RealPage13.

*CoStar Data, as of 01/27/2023

- May help mitigate the effects of Inflation: A hedge is a type of investment that has the potential to help protect investors against the decreasing purchasing power of the dollar when inflation hits. Multifamily typically has the potential to offer one of the strongest mitigations against the effects of inflation (which we analyze in this whitepaper), mainly because it entails relatively short lease terms (typically 12 months) that expire on a rolling basis throughout the year.

What are the potential cons of investing in multifamily real estate?

- Highly competitive asset class: Multifamily is one of the most sought-after CRE investment types. Institutions are most likely to prefer14 investing in this asset class, making it a highly competitive investing category among private real estate investors, high-net-worth family advisors, pension fund managers, institutional investors, and life insurance companies. As a result, multifamily assets tend to be priced more efficiently15 than other asset classes, meaning there is a lower probability of finding mispriced opportunities.

- Inflation hedge limitations: The 30-percent of income standard16 is a widely used and generally accepted measure to estimate apartment rental rates across a spectrum of renter demographics. Considering that rent is a component of monthly household expenditures, rental rate increases are ultimately constrained by household income growth. Therefore, to the extent that wage growth lags inflation-driven growth in operating expenses, landlords may not be able to increase rents at rates that meet or exceed inflation rates.

- High occupancy requirements: Generally speaking, annual tenant turnover is a reality for this asset class which means that marketing and leasing a property can be a never-ending process which enables landlords to increase revenues through higher lease rates. Also, acquiring debt for multifamily often entails minimum occupancy requirements. For most multifamily properties, occupancy is required at around 90%14 roughly 90 days before the loan is underwritten. High occupancy is typically crucial for the profitability and viability of a multifamily asset; therefore, most properties and lenders typically rely on 90%+ occupancy levels both to operate efficiently and to issue the loan.

- Risk of oversupply: When making investment decisions, it is prudent to observe which markets may be at risk of oversupply. As with any market, the multifamily sector is sensitive to changes in supply and demand. Excessive new construction can cause a market to overshoot with more supply than demand which can potentially create a state of disequilibrium.

- Illiquidity: Investing in multifamily real estate is typically a long-term investment with holding periods between 3 and 10 years. Unlike investing in the stock market, if you change your mind, you cannot exit your investment with the click of a button. Rather, you are committed to the investment for the entirety of its duration, which is subject to change. While this can be a pro for many investors, it may not suit your investment strategy, particularly if liquidity is one of your priorities.

If you are an accredited investor, you can join the CrowdStreet Marketplace and browse for multifamily real estate offerings. If you're just curious about this asset class, you can browse our investor resource center and educate yourself on various topics on CRE, including topics on multifamily. We provide periodic insights on the state of the CRE market on our website.

This article was written by an employee of CrowdStreet, Inc. (“CrowdStreet”) and has been prepared solely for informational purposes. The information contained herein or presented herewith is not a recommendation of, or solicitation for, the subscription, purchase or sale of any security or offering, including but not limited to any offering which may invest in the geographic area(s) or asset type(s) mentioned herein, whether or not such offering is posted on the CrowdStreet Marketplace. Though CrowdStreet believes the information contained and compiled herein has been obtained from sources believed to be reliable, CrowdStreet makes no guarantee, warranty or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the subject thereof. All projections, forecasts, and estimates of returns or future performance, and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions.Nothing herein should be construed as an offer, recommendation, or solicitation to buy or sell any security or investment product issued by CrowdStreet or otherwise. This article is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. CrowdStreet’s review process of any issuer or deal should not be construed as a recommendation or a solicitation to buy. All investors should consider their individual factors in consultation with a professional advisor when deciding if an investment is appropriate. Investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding.

Investing in commercial real estate entails substantive risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. All investors should consider their individual factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Direct and indirect purchase of real property involves significant risks, including without limitation market risks, risks related to the sale of land and risks specific to a given property, which could include the potential for property value loss, potential for foreclosure, changes in tax status and fees, and costs and expenses associated with management of such properties. All investors should consider risks specific to that given property prior to investing.

_______

Sources

15-https://www.investopedia.com/terms/p/price-efficiency.asp#:~:text=Price%20efficiency%20is%20the%20belief,is%20in%20the%20public%20domain.