Diversification is a core principle of portfolio management to minimize risk and achieve a higher overall blended return. Additionally, as part of a diversified portfolio, post Modern Portfolio Theory advocates a 10% – 20% allocation into hard assets such as real estate as a means to increase returns while also lowering risk, a concept that is referred to as moving closer to the efficient frontier. However, the principle of diversification doesn’t stop at the point of a real estate allocation; it also applies within the real estate allocation itself. Diversifying within a real estate portfolio is easily achievable but it requires an understanding of the different “levers” you can pull to generate it. In this article, we explore those levers and highlight the various ways to pull them to assemble a well-diversified real estate portfolio. In a follow up article, we will step through three hypothetical deals with cash flows to illustrate the effects.

Categories of risk components

The first step in building a diversified real estate portfolio is to understand the many different real estate strategy buckets. Investors can spread out risk by making allocations across those categories.

-

Geography: Location can be defined by a neighborhood, city, state, region or country. It also can be defined by the general size of the market, such as a primary or gateway markets, such as New York, San Francisco or Los Angeles, secondary markets such as Denver, Portland or Austin and smaller tertiary markets. You can mix all of these to create diversification.

-

Asset Class: Major asset class types include: office, retail, industrial, multifamily, hospitality, senior housing and storage. Real estate markets are cyclical with periodic ups and downs that can affect all asset classes or can affect some classes more and others less. One way to diversify against cyclical risk is by investing across asset classes.

-

Risk Profile: The risk of a project generally falls into one of four categories starting with low-risk, stable core investments known as “core” strategies and progressing further out on the risk curve to core-plus, value-added and opportunistic at the far end with the highest risk. For more details see my recent article, “Real Estate Investment Strategy: Four Categories of Risk & Reward”. When investing in real estate be wary of simply chasing the highest returns and ending up with a portfolio of highly risky real estate assets that can depend on speculative business plans. Smart investors know that not all IRR’s are created equal.

-

Income vs. Equity Multiple: Some properties generate steady, predictable cash flow, while other investments target upside at exit at the expense of little or even no yield or distributions until the property is sold. To create diversification blend income-producing opportunities with equity multiple driven ones.

-

Debt vs Equity: Investors can invest at different points in the capital stack on a real estate deal. Debt and equity deals have very different characteristics and come with different risk and return expectations (for more details see my recent article: “Debt Fund Investing 101”). Some investors may favor one over another, while others choose to place capital in both debt and equity deals. By investing up and down the capital stack you can diversify risk.

-

Sponsorship: Some investors are comfortable building a long-term relationship with one sponsor, while others may prefer to spread holdings among different developers, operators or capital providers. Others yet still, prefer to invest with multiple sponsors for a period of time and then re-invest with a select few after narrowing the field through experience. By diversifying across multiple sponsors you limit risks associated with sponsorship concentration. Finally, keep in mind that a tenured sponsor has learned many lessons over the years and uses this information to protect investors. Less experienced sponsors may be more error-prone but also may offer better terms to investors to compensate for their lack of comparative experience. These aspects make for good reasons to invest with different types of sponsors.

-

Holding Period: Short-term holding periods offer better certainty from a real estate cycle perspective but also intensify time risk since the business plan must unfold rapidly in order to hit targets. It is also more difficult to generate substantial equity multiples (for more details see my recent article: “The Yin and Yang of Equity Multiples and IRR”) Mid-term holding periods reduce time-intensity risk but might bump up against the end of a cycle. Long-term holding periods reduce both of these risks but also typically bring lower targeted annualized returns. Blending different holding periods helps to ensure you eliminate the possibility of having all of your exits come at the same time and potentially “wrong” time. Even in good times, exiting your holdings at the same time presents re-investment risk.

-

Business Model: Each deal usually has its own unique business plan or strategy, such as a new development, a long-term hold intended to clip a steady coupon or a value-added scenario with small cash flow but predominantly back end loaded. When investing, blend your strategies.

Eating My Own “Dog Food”

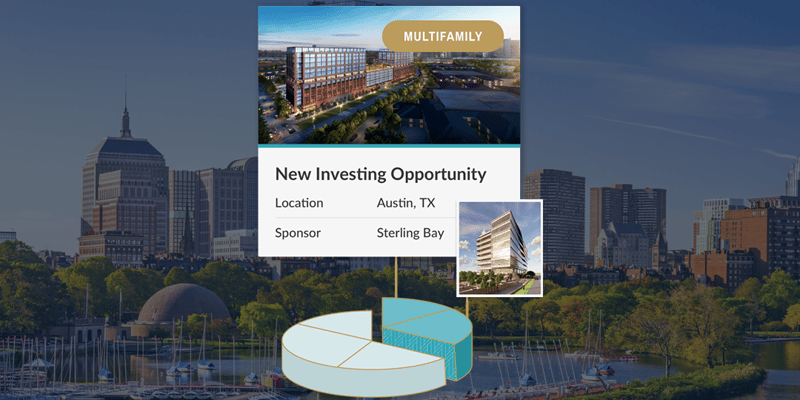

It is easy for investors to get blinded by targeted returns and pick deals solely based on the highest displayed numbers. However, as investors expand portfolios, it is important to take a thoughtful approach to selecting real estate investments. As an illustrative example, I myself, am a case study in creating a diversified real estate portfolio through multiple crowdfunded real estate investments. To date, I have personally invested in four CrowdStreet offerings. Here’s a summary of those deals:

|

Asset Class |

Strategy |

Location |

Sponsor |

Business Model |

|

|

Investment 1 |

Hospitality |

Core-Plus |

Tertiary / Midwest |

Unique |

High cash flow |

|

Investment 2 |

Office |

Value-Added |

Primary / West |

Unique |

Some cash flow with equity upside |

|

Investment 3 |

Medical Office |

Core-Plus |

Secondary / Midwest |

Unique |

Cash flow with equity upside |

|

Investment 4 |

Multifamily |

Develop – to – Core |

Secondary / West |

Unique |

No cash flow initially – then partial return of capital with cash yield on residual capital |

As I continue to build my own real estate portfolio, I will further look to further diversify through additional asset classes (e.g. retail and industrial), geography (e.g. East and South) and I may look to invest in debt since, to date, I have invested exclusively in equity.

Create Your Own Strategy

There is no one-size-fits-all strategy to diversification and my version, noted above, is simply one example. Investors might diversify assets across two or three different categories or they may choose to build in multiple layers of diversification. Some investors focus on one investment strategy, such as investing only in a single asset type that they know and understand. Other investors are strictly “core” investors and only invest in stable properties in gateway markets. Regardless of individual preferences, investors can still find ways to diversify even within narrowly defined investment parameters. Core investors can invest in different cities, such as New York, Chicago or Los Angeles, or they can invest in different types of properties in one city, such as an office building, hotel or apartment.

To get started in commercial real estate investing, my advice has always been to start with a particular opportunity that is compelling to you and, at least initially, not to worry about the categories of diversification. Once you have your starting point identified, begin to pull the levers of diversification as you add follow on investments.

The CrowdStreet Marketplace makes a point to include a variety of different types of offerings across its platform to help investors build portfolio diversity as they continue to increase their real estate investments. CrowdStreet also provides investors with a single dashboard to track and manage those investments.